Federal law requires property owners in high-risk flood zones to purchase flood insurance through the National Flood Insurance Program (NFIP) as a condition of federally insured financing. DOEE coordinates the District's participation in the NFIP, and works with the Federal Emergency Management Agency (FEMA) and District agencies on implementation. DOEE's flood risk management program has regulatory authority and also provides technical assistance to District property owners and other interested parties on issues such as the NFIP, floodplain management, flood insurance, floodplain development requirements, floodplain mapping, flood mitigation and coordination among federal and District agencies.

DOEE has developed an e-learning video series titled "Flooding in the District" a four-part series that seeks to explore DC's history of flooding, future flood risk, and what can be done to reduce the risk of floods and their impacts. Key topics include flood preparedness, infrastructure improvements that could reduce flood risk, and the potential for “blue-green infrastructure” such as floodable parks, porous pavement, and curbside raingardens to mitigate flooding.

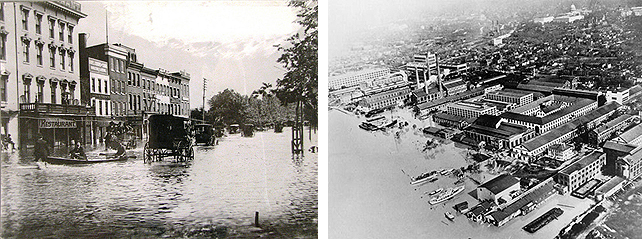

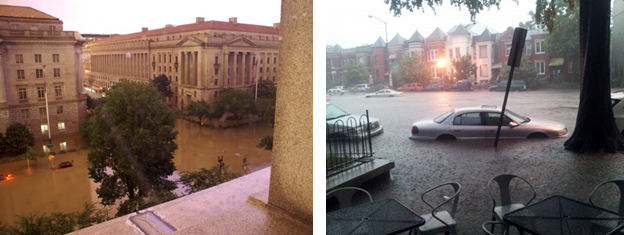

Flood History in Washington, DC

The District of Columbia has a long history of flooding, dating back to the 19th century. There are three types of flooding that the District faces: riverine, tidal/coastal storm surge, and interior. Major riverine floods occurred in 1936, 1937, 1942 and two in 1996. Major tidal floods occurred in 1933, 1972 (Agnes), and 2003 (Isabel). The most notable interior flooding events were in June 2006 in Federal Triangle and 2012 in Bloomingdale and LeDroit Park neighborhoods.

National Flood Insurance Program

The National Flood Insurance Program is a federal program managed by FEMA with the goal of reducing future flood damages. This program includes flood insurance, floodplain management and flood hazard mapping. Congress created the NFIP in 1968, with the passing of the National Flood Insurance Act, to address the fact that homeowners’ insurance does not cover flood damage and to offer an alternative to federal disaster relief programs.

Nearly 20,000 communities across the nation (including the District) now participate in NFIP through the adoption and enforcement of floodplain management regulations. In return, NFIP makes federally backed flood insurance available to homeowners, renters, and business owners in these communities, regardless of their flood zone risk level. NFIP also establishes building standards that help prevent flood damage, and develops maps of the nation's flood plains to create awareness of flood hazards and provide data needed to rate new construction for flood insurance.

Flood damage is decreased by almost $1 billion a year through community enforcement of floodplain management requirements and property owners who purchase flood insurance. In addition, buildings that are constructed in agreement with NFIP building standards experience about 80% less damage annually than those that do not meet the standards.

Watch informative videos to learn more about the National Flood Insurance Program and what you can do to flood proof your residence:

- Flooding in the District: Ep. 2 Part I – National Flood Insurance Program

- Flooding in the District: Ep. 2 Part II – Flood Proofing

Regulating Development

A primary role of DOEE within the District’s Flood Risk Management is to regulate development in floodplains in order to protect life safety and property, to protect the important environmental functions of floodplains, and to ensure the District’s continued eligibility for federally subsidized flood insurance and disaster relief through participation in the NFIP. DOEE regulates development in the floodplain by requiring building permits for new construction or development in the designated floodplains. All development projects in the floodplains must comply with the Title 12 DCMR - DC Construction Codes and Title 20 DCMR Chapter 31 - Flood Hazard Rules. For more information, visit Floodplain Development Permits.

DOEE is also planning to update the Flood Hazard Rules. See the proposed changes and progress.

FloodSmart Homes

The FloodSmart Homes Program, which is one component of the DOEE Flood Program, addresses the flooding problem by funding resilience upgrades that reduce the risk of flood damage and protect life safety. Whereas other flood risk management programs focus on neighborhood-scale approaches to reducing flood risk (such as levees, or blue-green infrastructure), FSH focuses on making resilience improvements at the individual building scale. The resilience upgrades will help families stay in their homes after a flood, reduce the cost of flood insurance, reduce or eliminate the cost of repairs post flood, and improve health outcomes. Read more>>

DC Silver Jackets Team

DOEE is a co-leader and founding member of the District of Columbia Silver Jackets Team. This interagency team is comprised of members from federal, District of Columbia and regional agencies, as well as academia. The DC Silver Jackets Team leverages resources to identify and implement comprehensive, resilient, and sustainable solutions to reduce flood risk around the District and to assist local communities. For more information, please visit Silverjackets.

Blue Green Infrastructure and Cloudburst Management

DOEE is working with sister agencies to identify opportunities to use blue-green infrastructure and cloudburst management strategies that will reduce the city’s risk of flooding from intense rainfall. The report below details the concepts of this new approach and the results of a workshop held in March 2019 where District agencies and stakeholders gathered to learn more about the concepts and explore how they could be applied in the District. Read the report >>

To learn more, please watch Episode 3 of the Flooding in The District e-learning series, which explores the integrated approach the District government is exploring with public space construction projects through Blue-Green Infrastructure (BGI).

Resilience Focus Area Strategy

DOEE’s Flood Team’s roadmap for prioritizing flood resilience planning work across multiple communities affected by floodplains and interior flood risk. The Resilience Focus Area Strategy (RFA Strategy) ranks communities in the District according to flood risk and concentration of vulnerable populations. Read More>>

Watts Branch Neighborhoods Flood Risk Management

DOEE is working with sister agencies to better understand flood risk in the Watts Branch area, a neighborhood where many homes are in a floodplain and at risk of flooding. The following page provides status updates, access to the Watts Branch Flood Risk Management Plan, and links to Watts Branch flood risk e-learning video modules. Read more>>

SW-Buzzard Point Flood Resilience Strategy

SW/Buzzard Point Flood Resilience Strategy will design an integrated network of Blue/Green Infrastructure (BGI) to protect the SW and the Buzzard Point communities from interior flooding due to extreme rain events. The strategy will re-design open spaces and streets to function as a network of connected, floodable, multipurpose infrastructure projects that can absorb and contain excess stormwater during extreme rain events. Read more>>